A “LOT” in Forex refers to a unit amount that can be used for investing and trading in the Forex market. In other words, this unit is a standard trading unit, where each LOT is equal to 100,000 units of the desired currency. There are different types of LOTs, including standard LOTs, mini LOTs, micro LOTs and nano LOTs, which are used for transactions. It should be noted that LOT is able to determine the amount of capital and the volume of transactions and accurately determine the profit and loss resulting from this investment. LOT in this market provides a suitable environment for traders to facilitate the management of risk and profit according to a specific strategy and planning. By using LOTs in Forex, merchants and traders know how much of their capital to spend in each transaction; In addition, they can adjust and check the volume of their transactions accurately.

It is worth noting that the use of LOTs in Forex trading is a very practical method with the aim of measuring business performance, capital management and risk control. If you want to get familiar with LOT in Forex, LOT types and how to calculate the value of trading volume in Forex and work more effectively in the Forex market, stay with us.

What is LOT?

One of the most basic concepts for investing in the Forex market is the concept of LOT, which has a special application in determining the amount of investment in financial markets, especially the cryptocurrency market. In fact, LOT is able to show a certain amount of a capital and identify the volume of transactions; For this reason, you can measure the amount of your capital in the Forex market with the LOT unit.

As mentioned before, the use of LOT in Forex helps investors to accurately manage their assets and transactions to have great ease and clarity in the market.

Note that each LOT represents a certain amount of your capital; for example, if you have one LOT, it means that the amount of money you have in your account is represented by one LOT.

Items such as gold, silver and oil barrels can also be counted with LOTs. Every 100 ounces of gold, every 5000 ounces of silver and every 1000 barrels of oil are equal to one LOT.

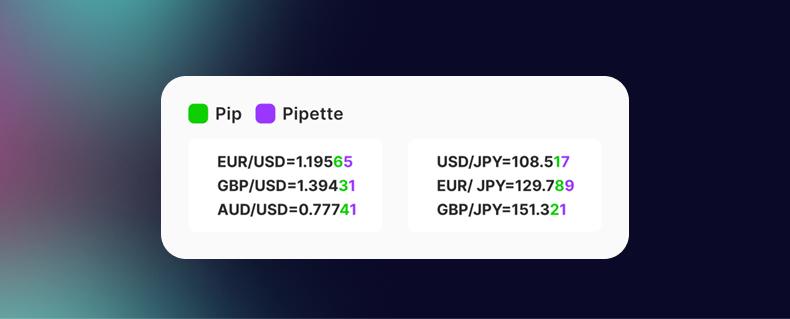

Another important point is to be familiar with one pip of each LOT, which means one percent of one hundredth of the LOT, which is equivalent to 10 units. For example, one LOT of dollars is equal to 100,000 dollars; therefore, one pip of this LOT is equivalent to 10 dollars.

It should be mentioned that different types of LOTs can be traded, which you will get to know fully in this article.

Different LOT types in Forex

1. Standard LOT: This LOT is used as the main unit of measurement in Forex and is suitable for transactions that are riskier and involve larger funds. To use the standard LOT in Forex, at least 25,000 dollars of capital is needed, and for this reason, big investors use this type of lot to carry out their transactions. It should be noted that each standard LOT is equal to 100,000 units of the desired currency, and it is also equivalent to 100,000 dollars for the “dollar” currency. The rate of profit per pip in standard LOT is equal to 10 dollars.

2. Mini LOT: This LOT type is an ideal option for novice traders to enter the world of Forex trading and is known as an average and suitable measurement unit. The unique features of this LOT facilitate the management of market fluctuations for traders. Mini LOT is one of the most popular LOTs in Forex and the minimum capital required to start trading is $100. Each profit pip in this

LOT has a value of 1 dollar

3. Micro LOT: Micro LOT is suitable for people who have a lower risk tolerance and in fact, it is a more moderate option than the mentioned LOTs. This LOT type provides a suitable field for traders who are inclined to small volume transactions and have limited capital. If traders choose micro LOTs accurately and according to their trading strategy, they can have an enjoyable experience whilst achieving profit in the Forex market. It is worth noting that each micro LOT is equal to one thousand units of the desired currency and each profit pip in this LOT has a value of $0.1. Note that the minimum capital required to start trading with this type of LOT is $1.

4. Nano LOT: Each Nano LOT is equal to one hundred units of the desired currency. This LOT is known as the smallest unit of LOTs. It should be noted that the value of each profit pip in nano LOT is lower than other LOTs and is equivalent to $0.01. Since this LOT has a small size, it is used rarely and only in transactions with lower risk.

How does LOT work in the Forex market?

As you know, LOT is used as a metric unit in Forex trading. In fact, in this market, traders trade based on LOTs and pips. LOTs are the index of traders’ investment unit and pips are their profit or loss index, and according to the type of lot they have in mind, the profit or loss is converted into currency. Among the advantages of using lots in Forex, we can mention speeding up and making transactions easier, due to the need for less calculations; additionally, because each LOT represents the capital with an integer number, the capital amount of individuals can be determined only by multiplying the LOTs.

How to calculate LOT and value of trading volume in Forex

1. Calculating LOT in the Forex market: Suppose an investor intends to risk 1% of his assets from a trading account that has a balance of $10,000 on one trade. He wants to trade the EUR/US currency pair, which usually moves in pips. As you know, a pip in Forex shows the smallest price increase or decrease for the mentioned currency pair. Currently, the exchange rate of the currency is equal to 1.2000 and the trader believes that the price will increase; also, he has set an opening point at 1.2050 and a stop loss order at 1.2000 to minimize his potential loss.

To calculate LOT in Forex, the number of pips at risk and the value of each pip should be considered. Note that the difference between the entry price and the loss limit of this trader is 50 pips, and the standard LOT size for the currency pair in Forex is 100,000, and each pip in the standard LOT size has a value of $10. Now this trend can be calculated with the following equation:

Lot size = (loss limit in pip x value of each pip) ÷ maximum risk per trade

2. Calculating the value of the transaction volume in the Forex trading market: Imagine a trader wants to open a deal to buy assets in the amount of one standard LOT in the GBP/USD currencRemove featured imagey pair with an exchange rate of 1.2233. Considering that he needs to buy 100,000 pounds or one LOT, his account balance is in dollars; therefore, in order to find out how much money in dollars should be paid for this transaction, he must multiply the exchange rate by one LOT. The following formula helps to figure out the transaction value:

Transaction value = exchange rate x LOT amount

How much does each LOT cost in dollars?

To know how much each LOT is in dollars, you need to consider the exchange rate of the currency pair you that you have in mind. To learn this issue more easily, we suggest you to pay attention to the example below.

Imagine a trader wants to calculate the value of one LOT in USD with an exchange rate of 1.04410 in the EUR/USD currency pair. To achieve the desired goal, it is only necessary to multiply one LOT, which is equivalent to 100,000 units, by the mentioned exchange rate. It is better to know that with the changes in the price of these currencies, these numbers are also subject to change.

The amount of LOTs in the Commodity market

In different types of financial markets, the concept of LOT is used to show the standard unit of transactions for a special capital; in addition, LOT size and quantity both depend on the type of market. The LOT size can play an effective role in the reward and risk of the transaction. If the result of the transaction is successful, the larger the LOT size, the more profitable; but when the result of the transaction is not successful, many losses are included in this transaction. That is why choosing the right lot size is important for trading strategy and risk tolerance.

What is the maximum and minimum amount of lots in Forex?

Usually, the maximum amount of LOTs in Forex is 50 LOTs, and the minimum amount of LOTs in the Forex market is 0.001 LOTs. Most brokers consider the minimum amount to be 0.01.

Determining the most suitable lot for traders

As you know, lot size specifies the number of units of a special asset that are traded in one symbol. Determining the right LOT for the transaction also depends on the effective factors that we will discuss in the following lines.

1. Account Size: Larger accounts are a very good option for paying the larger LOT sizes, and smaller accounts are suitable for paying smaller LOT sizes.

2. Risk tolerance: In order to choose the right LOT, the traders need to consider their level of tolerance and risk tolerance. It is better to know that larger lot size increases profit and loss; but if you choose a smaller LOT, the profit will be limited and the risk and possible loss will also be reduced.

3. Trading strategy: Some trading strategies aim at low profits and frequent trades with smaller lot sizes; like scalping or day trading.

Swing or position traders also use strategies that hold trades with larger LOT sizes for longer periods with the aim of capturing larger price movements.

The role of lots in the spread of Forex trading

It is necessary to know that the broker needs spread and margin to earn profit. Margin is the amount of money that needs to be deposited to the broker in order to open a trade.

1. The effect of LOT on the size of the spread:

Bigger LOT = Bigger spread Smaller LOT = Smaller spread

2. The effect of LOT on margin:

Bigger LOT = More margin Smaller LOT = Less margin

The relationship between lot and leverage in Forex

Leverage in Forex is a type of interest-free loan from the broker and allows individuals to trade with more money than their account balance. This issue increases the profit and loss of traders in the same proportion. The higher the leverage, the bigger LOTs can be traded. It is better to adjust the leverage more accurately and according to the desired LOT and your risk tolerance.

Choosing the right leverage is necessary, because trading with leverage is extremely risky.

Trading volume in the Forex market

In the Forex market, trading volume indicates the amount of base currency that is bought or sold in a transaction. Based on what was said in this article, the unit for counting the volume of transactions in Forex is called a LOT, and each LOT represents a fixed amount of the base currency. This fixed value can be different according to the type of LOT.

The relationship between risk management and trading volume

In the Forex world, risk management plays an essential role in the success of traders. One of the key tools in this field is the Stop Loss. However, the effectiveness of this tool is highly dependent on your trading volume.

Professional traders typically risk between one to three percent of their total account balance on each trade. For example, if your account has a balance of $1,000, your maximum allowable loss per trade would be $10, assuming a 1% risk.

Now suppose you plan on trading one LOT in the EUR/USD currency pair using leveraged trading. In this case, you will lose $10 for every pip change in the price against your prediction.

In this example, if you set the stop loss to 5 pips regardless of your risk level, if it activates, you will lose $50, which is 5 times your 1% risk limit. Continuing this process can quickly wipe out all of your account balance.

Conclusion

Financial markets, especially Forex, which is known as the world’s largest financial market, are a world full of mystery and complexity. Entering this field without sufficient knowledge and skills will not bring benefits and can lead to heavy financial losses; therefore, the first step in Forex trading is to gain knowledge and education. On this path, it is necessary to familiarize yourself with the key concepts and terms of this market, such as (LOT) which is one of the important concepts, and formulate your trading strategy. It is worth noting that choosing the right LOT for each transaction plays a fundamental role in determining the amount of your profit and loss; for this reason, our intention of publishing this article was to familiarize you with LOT in Forex so that you can get a pleasant experience from this investment.